alternative investments moved from niche to mainstream in 2025

15 December 2025Source: MoneyWeb

This year confirmed that alternative investments are now too big and too important to ignore. McKinsey’s Asset Management 2025 report identifies ‘The Great Convergence’ between traditional and alternative asset management as the industry’s dominant theme over the next five years, with the high-net-worth segment ($1 million+ in investable assets) expected to drive much of that shift.PwC’s research agrees – the firm projects that alternatives will outgrow both mutual funds and institutional mandates over the next five years. Even traditional giants are pivoting. In his latest annual investor letter, Larry Fink, Chairman and CEO of BlackRock, states: “BlackRock has always had a foot in private markets. But we’ve been, first and foremost, a traditional asset manager. That’s who we were at the start of 2024. But it’s not who we are anymore.”

The shift to alternative investments

The numbers tell a similar story:

- High-net-worth allocations to alternatives have grown from an average of around 3% a decade ago to 16% today [1]

- This is expected to continue to increase. As an example, Bank of America now recommends a 25% alternatives allocation for its high-net-worth clients

- This remains well below the current family office average of between 44 and 54%, depending on geography.

Advisers are moving just as rapidly. A September 2025 survey by AssetMark found that 91% of advisors believe that private market access is now essential for differentiation. Of the advisers who currently do not allocate, 68% plan to begin allocating within the next 12 months.

Private markets lead the way

As AssetMark’s CEO, Michael Kim, put it: “Private markets are no longer optional – they’re a strategic necessity.” Globally, approximately 88% of companies are private[2]. Companies are staying private far longer (the average age at IPO has risen from eight years in 2004 to 14 years in 2024). In the listed markets, the Magnificent Seven now account for around 35% of the S&P 500’s total market cap. The reality is that the public investment universe is small and becoming increasingly concentrated and correlated.

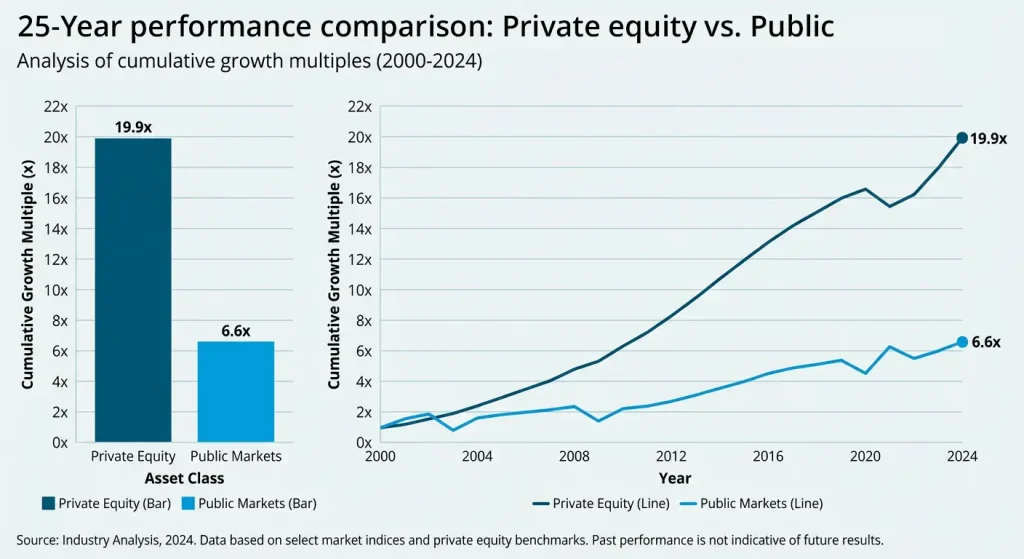

Interestingly, while illiquidity is often framed as a drawback, global private equity firm Permira finds that the illiquidity and long-term time horizon inherent in alternatives drives significant outperformance relative to public markets. This differential gets larger the longer the time horizon is extended.

Mainstream adoption and therefore capital flows have, of course, brought fierce competition and compressed returns in large-cap private markets. For this reason, Westbrooke has stayed disciplined in our lower- and middle-market focus, where capital is less available, pricing remains attractive, and there are still opportunities to focus on capital preservation while earning asymmetric returns on the upside.

For over 20 years, we have developed a proven, robust global investment process and platform, investing our own and our clients’ capital through multiple cycles and macro conditions. This platform gives our clients unique access to the long-term compounding potential that only aligned, experienced, and disciplined private-market investing can deliver.

Westbrooke’s 2025 investment statistics

Westbrooke now manages R16 billion ($935 million), with our shareholders and management our single largest investor, ensuring complete alignment.

Our investment activity for 2025:

- Transactions completed: 49

- Deployed: R4.6bn

- Exits (incl. refinancing): 37

- Exited: R2bn

The rigorous implementation of the Westbrooke Investment & Risk Philosophy and Approach has resulted in our historic annualised loss ratio through all cycles (including the global financial crisis, Brexit, state capture, Covid, multiple geopolitical challenges, wars as well as high interest rate environments) amounting to less than 0.1% p.a. This is over a 21 year track record where we have invested R22 billion (nominal amount not adjusted for inflation) across 560+ transactions.

The future of alternatives

Westbrooke’s offering spans private debt, private equity, hybrid capital, real estate and tax-enhanced investing across the UK, South Africa and the USA. We provide clients with a gateway to private market opportunities which are typically hard to access, enabling them to move toward the 25%+ private market allocations now common among sophisticated investors globally.

[1] Capgemini, 2025

[2] Companies with revenue of $100m+. BlackRock, 2025