Westbrooke Alternative Asset Management UK (“Westbrooke”) is pleased to announce the successful conclusion of a preferred equity investment in Melrose Education Investments Ltd (“Melrose”), as part of a total £17.5m of committed equity capital, in partnership with Innervation Capital Partners. This is Westbrooke’s second transaction alongside Innervation Capital Partners.

Melrose’s strategy is to create one of the UK’s leading independent specialist Special Educational Needs (SEN) providers in a fragmented and under-served market.

James Stirling, Head of Westbrooke’s Hybrid Capital strategy in the UK commented, “We are really pleased to be working with Innervation Capital Partners again in this buy-and-build strategy. They have an excellent values-led track record in the Education sector and we are working with a first-class management team led by Tracey Storey, whose vision is to create an engaging and broad curriculum which raises aspirations and inspires positive changes in learners.”

This investment fits squarely within Westbrooke Hybrid Capital’s ambition to back excellent management teams deliver their growth ambitions within UK lower-mid-market companies, with highly flexible debt and minority equity capital funding solutions.”

Tracey Storey, Chair at Melrose Education said, “Melrose Education is thrilled to be working with Westbrooke Alternative Asset Management as we grow our group of premium special education needs and alternative education schools in England. Having worked with Westbrooke previously, it is a privilege to be partnering with them again at the start of our exciting journey.”

About Westbrooke

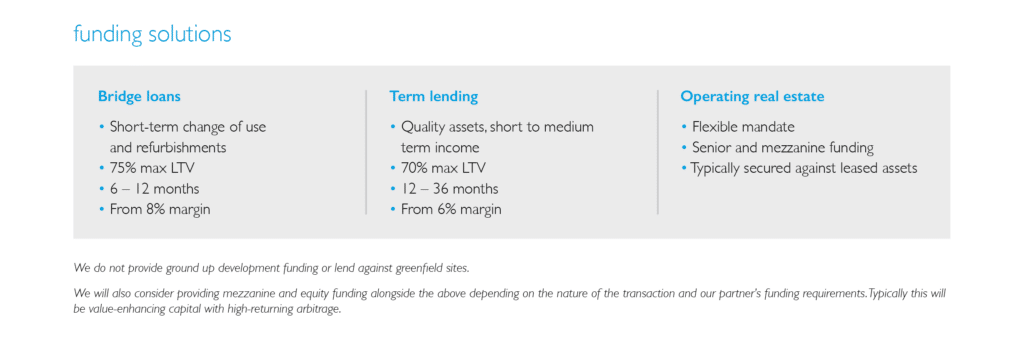

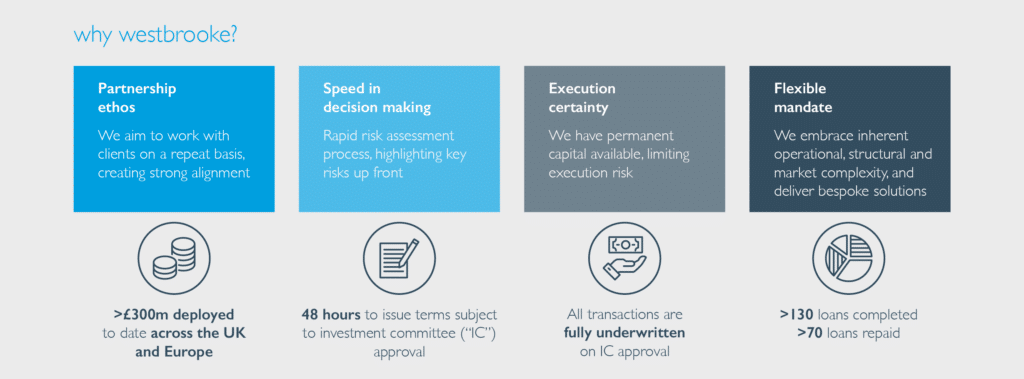

Founded in 2004, Westbrooke was established as a multi-asset, multi-strategy manager of alternative investment funds and products. Westbrooke invests and manages capital in multiple geographies on behalf of its shareholders and investors in private equity, venture capital, private debt, hybrid equity and real estate.

In the UK, Westbrooke buildsstrong relationships with entrepreneurs, management teams and private equity houses, providing flexible and agile financing solutions to growing companies with EBITDAs between £1m – £10m. We focus on providing intermediate capital and minority equity on either a standalone basis or as part of an integrated finance structure, tailored to each client’s needs.