In a world where investors are seeking alpha in their portfolios, alternative assets are resonating with clients looking for private market investment opportunities. At Westbrooke we are focused on what is called “South African connected capital” – and we now manage more than R12bn of this capital.

In this podcast with Dino Zuccollo, Head of Investor Solutions at Westbrooke, the Magic Markets hosts delved into topics including:

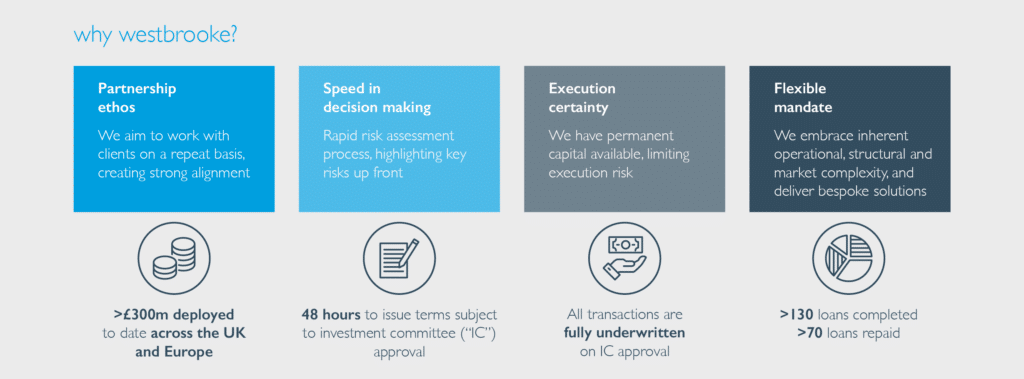

- The extensive activity in the portfolios and the different types of mandates run by Westbrooke, ranging from the flagship Yield Plus fund through to private equity, solar and other opportunities.

- In an environment of shrinking opportunities in public markets, the growing trend of institutional support for alternative assets and the due diligence that was required for this to become a reality.

- The importance of alternative assets in facilitating flows through the financial system from investors to those seeking capital for opportunities.

- Why the provision of a secondary market is difficult for alternative assets and how liquidity risks are handled by the investment manager.

- The increasing popularity of tax-enhanced investing in response to fiscal incentives for the installation of rooftop solar in South Africa.

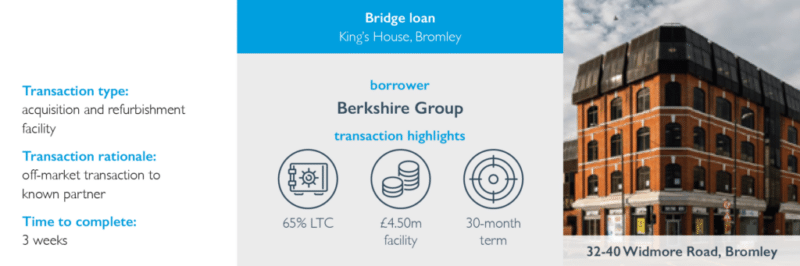

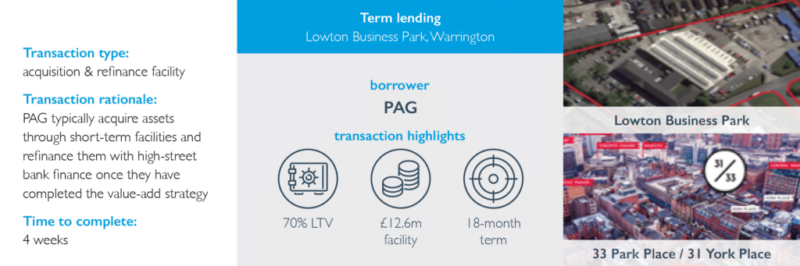

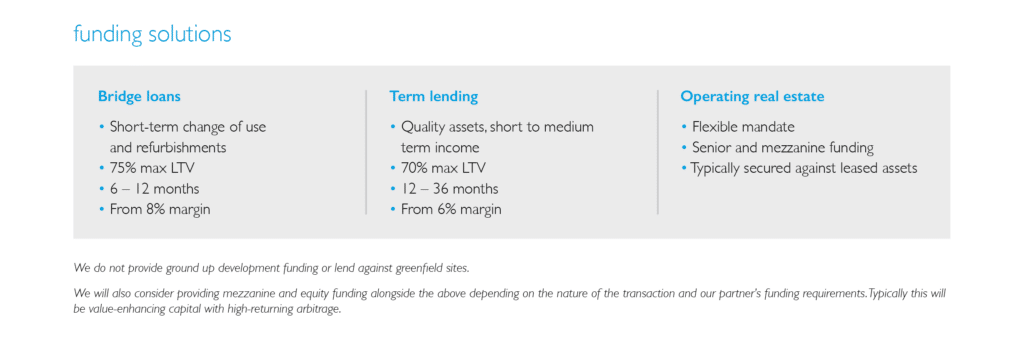

- An overview of the type of real estate transactions in which Westbrooke looks to participate.

- How the credit loss ratio in the private debt portfolios compares to the ratios reported by large corporate banks.

- Why investing alongside other professional investment houses in private equity deals is a popular approach.

Listen to the full podcast here: