By: Marc Hasenfuss Source: FinancialMail

Share price offers investors an intriguing opportunity and latest share register reveals some interesting movements too.

Something is afoot at Stellar Capital Partners (SCP), judging by recent movements on the heavily discounted investment company’s shareholder register.

SCP has retail tycoon Christo Wiese (still knee-deep in the Steinhoff mess) as an anchor shareholder. But the latest share register shows the emergence of three new entities as significant shareholders in recent months, and speculation is that Wiese may be getting a bid for his SCP shareholding.

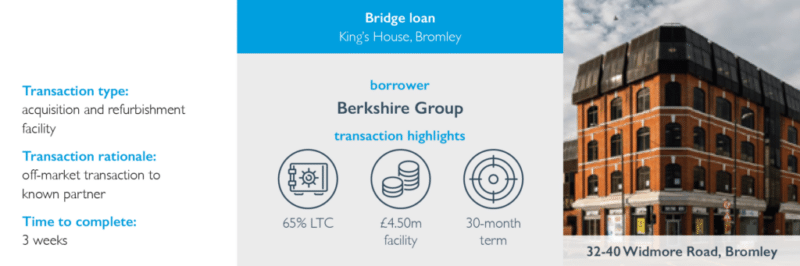

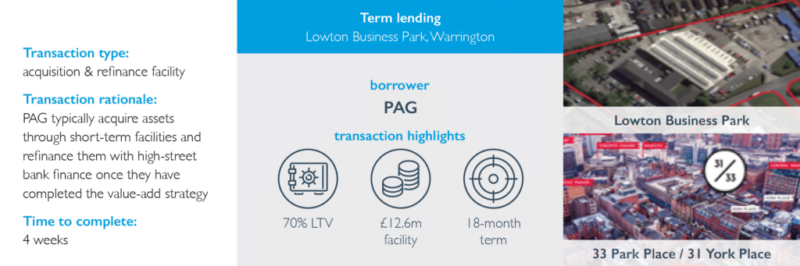

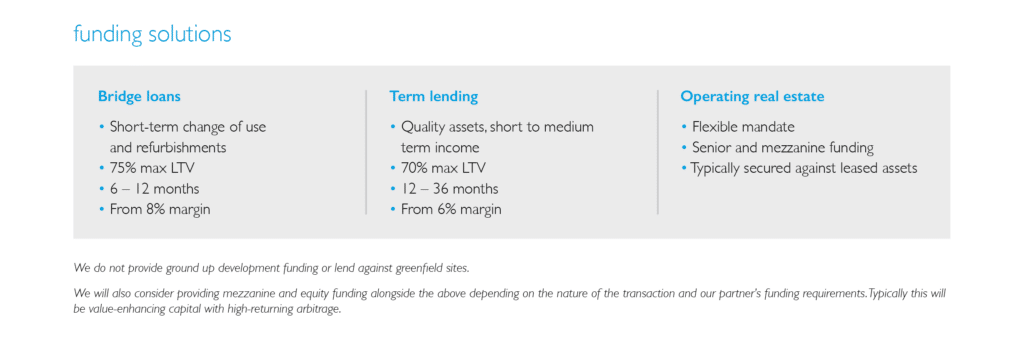

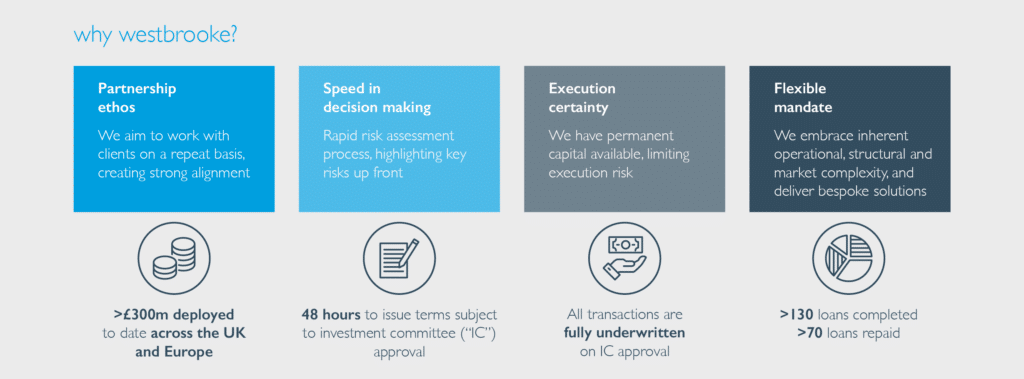

Financial services group Genesis Capital Partners, controlled by the Levick family, recently almost doubled its holding in SCP to around 12m shares, while Hollard-aligned Westbrooke Special Opportunities has built a position of 37m shares.

But arguably the most interesting aspect is the 8.5m shares acquired by Rational Expectations — an investment vehicle associated with Capitec Bank founder Michiel le Roux.

One market watcher suggests the shareholder register might be showing vultures circling over undervalued spoils. SCP, which is a curious mix of industrial and financial services and electronic manufacturing, trades at a discount of more than 40% to its last stated intrinsic net asset value.

The emergence of Genesis — which already holds a range of financial service assets — is intriguing, as SCP’s largest investment is a controlling stake in well-regarded fund manager Prescient.

Westbrooke, on the other hand, was a major shareholder in security technology company Amecor, and played a central role in selling this highly profitable business to SCP in 2016. Westbrooke also played a key role in selling automotive group Control Instruments to Torre Industrial, which also forms a large part of SCP’s investment portfolio.

Westbrooke executive Jarred Winer tells the FM there was good value on show in SCP, with the share price offering an enticing discount. “We would like a more active approach to unlocking value, though,” he says.

Rational Expectations also has a connection with SCP, with both companies holding strategic stakes in vehicle tracking group Digicore — which was subsequently acquired by US-based firm Novatel Wireless in 2015.