MoneywebNOW with Simon Brown – Westbrooke Yield Plus is now a £130m fund with 48 loans in it

Westbrooke’s head of Investor Solutions Dino Zuccollo discusses the company’s latest private credit offering in sterling.

SIMON BROWN: I’m chatting now with Dino Zuccollo, head of product development and distribution at Westbrooke Alternative Asset Management. Dino, I appreciate the time today. We chatted around your secured UK Private Debt Fund last year, but of course these funds fill up. You’ve got a new one coming through. A lot of folks are going to say, ‘Hang on a second. Private debt is risky’. But I’ve been doing a lot of digging around this over the last couple of weeks and months. It often isn’t, and partly because the managers – ie your team – are so much more on the ground and involved with the clients.

DINO ZUCCOLLO: Yes, Simon, it’s a very good question. Interestingly, the alternative to investing in private debt is generally fixed income, cash or some kind of a bond. Interestingly, in our private-debt offering in the UK there are a number of businesses that we have lent to where we are a secured lender to them. And that business as a wider business also issues listed bonds.

Now a listed bond generally is an unsecured claim against a borrower. But what’s interesting is that in many of the instances we have lent at a higher rate with better security to that business than at the rates that their listed bonds are trading at. So I would say that private debt is not necessarily riskier; it’s that the risks are different. Because you’re assuming certain of those different risks, as well as hopefully investing with a manager who knows what they’re doing, you can extract higher returns than the level of risk you need to take in order to extract those returns.

SIMON BROWN: What would you say the difference is, because I’m fascinated by your example there of issued bonds?

DINO ZUCCOLLO: What is an ‘alternative’, Simon? It’s anything that is unlisted or illiquid, so it’s probably better described as a private market asset. And alternatives globally are a multi-trillion dollar industry in the developed markets these days.

The risks in alternatives generally are things around liquidity; so by investing in a private-market asset you can’t get your money out tomorrow. There is less, I suppose, transparency with certain managers and accessibility is incredibly difficult, especially here in South Africa. That’s a mission we as Westbrooke are on – to try and make alternatives more accessible to the wealth public, [and] to direct clients to institutions, etc.

But I would say in exchange for higher returns and better predictability and less volatility you’re probably taking liquidity risk, and of course more manager risk – with the caveat, I suppose, that it depends on whom you’re investing with.

SIMON BROWN: I take your point on the liquidity risk. This is not a share which I can buy and immediately turn around and sell, assuming that it’s a liquid share. Your funds as I understand have got initial lock-in of either 18 or 36 months. If you’re buying one of these, you really should understand that liquidity profile.

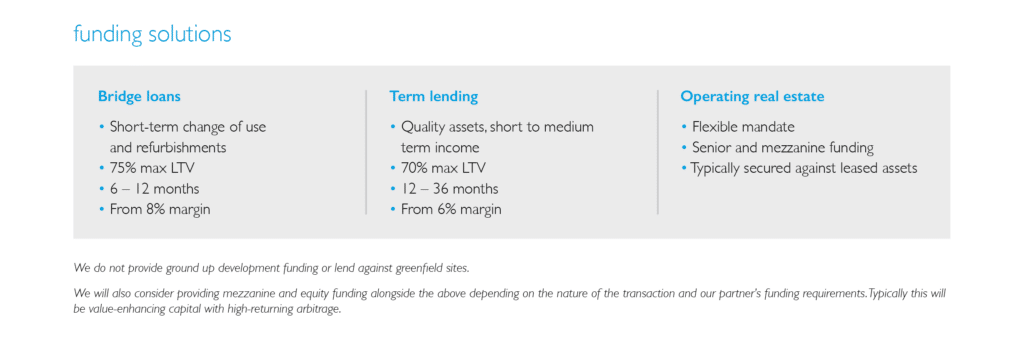

DINO ZUCCOLLO: Yes, absolutely. It’s fundamental. What do you do in a private debt fund, Simon? You make loans. In the case of Westbrooke Yield Plus, which is our flagship UK private-debt fund now yielding about 9.5% in sterling, we make loans to real estate sponsors primarily. Those loans are generally [over] somewhere between 12 and 36 months. If we were to promise an investor that they could get their money out in, let’s say, three months, you’d have a mismatch between the duration of the underlying loans and the duration of the clients.

There are some private debt funds that operate on that basis out there, but what they do is they hope that you never get enough redemptions from clients in any one quarter for there to be a problem, because they build cash buffers in and sometimes they have debt facilities, etc.

DINO ZUCCOLLO: The problem with that is when you have a run on the fund – let’s say there’s Covid and everybody wants their money back – you then have to do something called gating. Gating is when you say to clients, ‘Sorry, you can’t get your money back within the terms that we promised you, you’re going to have to wait’. At least the way we manage it is we never want to mismatch the duration that our clients come in for with the duration of our loans, and so we lock them in for a period that matches the average duration of the loans that we write to people in the UK market.

SIMON BROWN: Gotcha – so that they fit together and they’re in sync. How many clients have you got within the space that you’re lending to? I mean, how big is this, the portfolio?

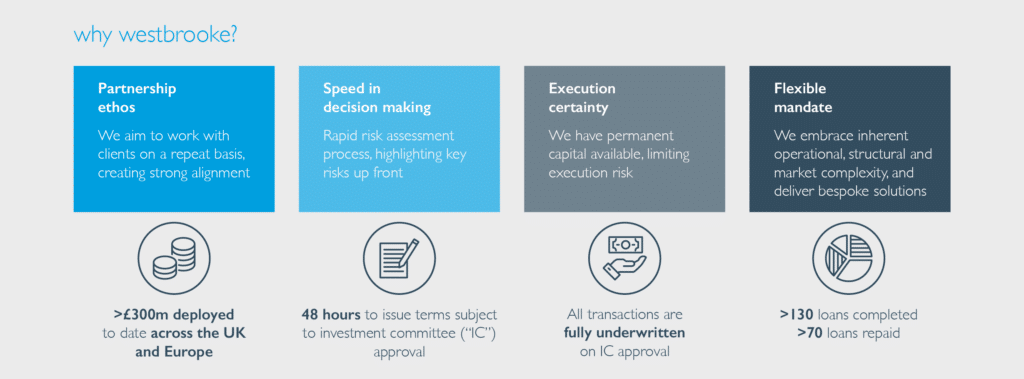

DINO ZUCCOLLO: Westbrooke Yield Plus is now a £130 million fund with 48 loans in it. So it’s quite nicely diversified. No one loan in that portfolio is more than 7.5% of the overall NAV of the fund. It’s been going for six years now and fortunately, touch wood, has never had a down month.

I suppose for those prospective investors listening to this the point to take out of that is that alternatives are much more nascent here in South Africa but, when implemented properly, they don’t necessarily construe higher risk. As a result, if you look in places like North America, in Europe, the EU alternatives are generally between 10% and 20% of client portfolios. In South Africa we’re nowhere near that number – probably between 0% and 5%, based on the clients that I talk to.

SIMON BROWN: I was going to say certainly under 5%. You mentioned a yield of 9.5%, and of course that is in sterling. What is your distribution frequency? Is this rolled up and paid at the end, or is it quarterly? How does that work?

DINO ZUCCOLLO: We pay out distributions at the moment every six months. But clients also have the option to roll it up, to your point. What I find very interesting, Simon, is that the vast, vast majority of our clients have elected to be in the roll-up class because it is so much more tax efficient. It shows me something in relation to investor behaviour, which is that clients are looking at the moment to invest somewhere in hard currency where capital preservation is the focus, where they know that they can sleep well at night because they’ve got diversification and security. They don’t want to go into equities in this volatile market, but they don’t actually need the cash flow. As a consequence, they’d rather have the tax efficiency in a roll-up class.

SIMON BROWN: I take your point, and it depends on your cashflow need.

We’ll leave it there. Dino Zuccollo, head of product and development and distribution at Westbrooke Alternative Asset Management, I appreciate the time.

Listen to the full podcast below: