Westbrooke Alternative Asset Management UK (“Westbrooke”) is pleased to announce the provision of a £6.4m senior debt facility secured on two retail/commercial assets. The facility supports the refinancing of a superior regional retail site, Eureka Place and aids the acquisition of Churchfields & Shore House, a retail and office asset in Bristol.

Eureka place boasts long-standing blue-chip tenants with long-term leases, whilst Churchfields & Shore House is situated in a strong Bristol location, currently offering retail and office space. Liquidity for regional retail/office has materially weakened over the last 3 years but the strong and granular income profile allowed the Westbrooke Real Estate lending team to provide innovative financing solutions for our partners, who have a notable track record in managing and enhancing value within their portfolios.

Harry Newall, Westbrooke Alternative Asset Management – “It has been pleasant working with a new partner on this transaction, their track record for delivering on value-add business plans in the office, retail and residential sector is exactly the partners we seek to support. As is often the case, the transaction timeframe was tight, but through our permanent capital base we were able to deliver on the requirements.”

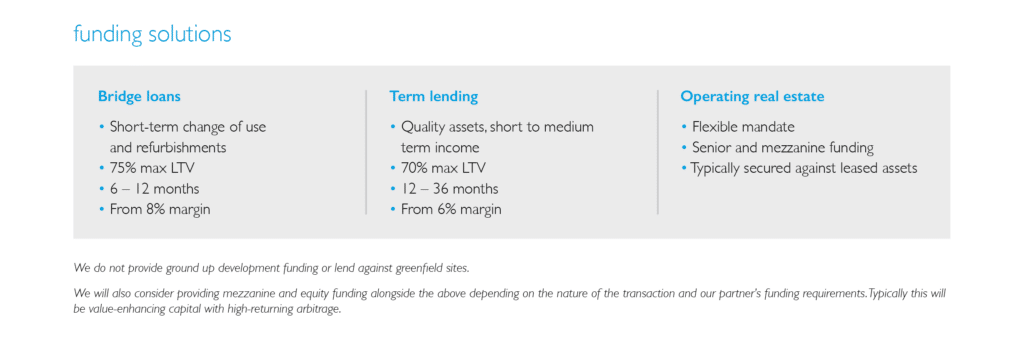

For more information on the lending solutions Westbrooke UK offers in the real estate sector, download our overview brochure here or get in contact with the team to discuss your requirements.