Dino Zuccollo, Head of Distribution for Westbrooke South Africa, together with Richard Asherson and James Lightbody from the Westbrooke UK team, were recently interviewed for Episode 127 of the Magic Markets podcast. They discussed the Quarter 2 Private Debt capital raise in the Westbrooke Yield Plus Fund, and shared case studies of how some of these deals are structured.

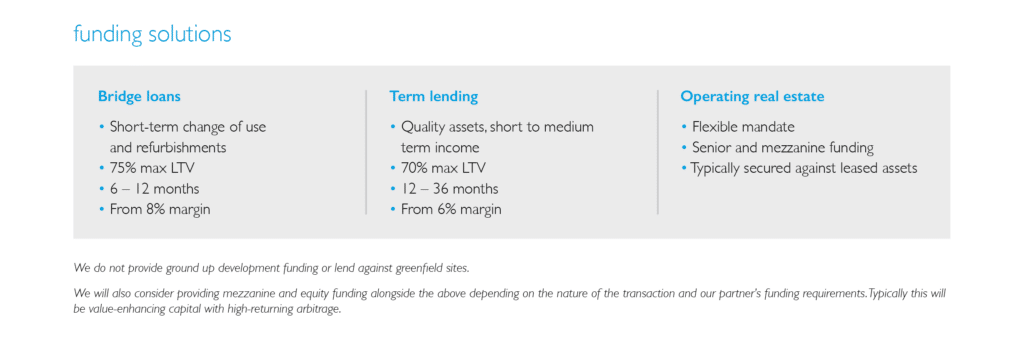

The Bank of England has raised interest rates at an extraordinary pace, which has led to a genuinely appealing yield on the base rate in the UK. This presents opportunities for the Westbrooke Yield Plus Fund and for investors. Westbrooke targets a return of well above the cash rate in the UK by lending in the private debt market, with the current annualised yield sitting at 9%.

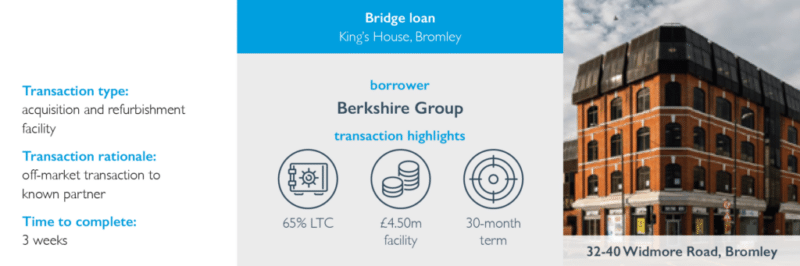

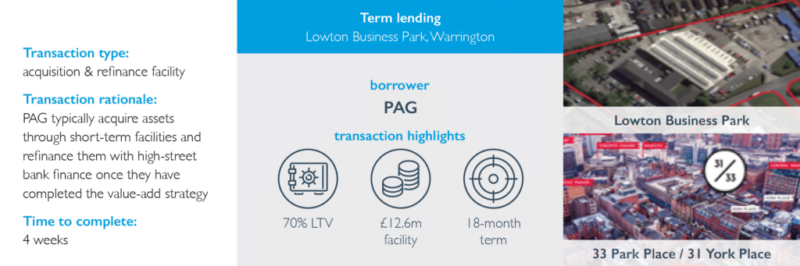

To understand more about the underlying exposure, the team explained a detailed example of the types of deals in the Fund and the level of security negotiated on the loan. This demonstrates why Westbrooke can compete in a space where large commercial banks struggle to justify the structuring efforts required to optimise the risk-return profile.

Key takeaways from the interview includes:

- The Westbrooke Yield Plus Fund is a high-yielding, fixed income alternative investment that provides investors with exposure to the UK private debt market.

- The Fund targets a return of well above the cash rate in the UK, with the current annualised yield sitting at 9%.

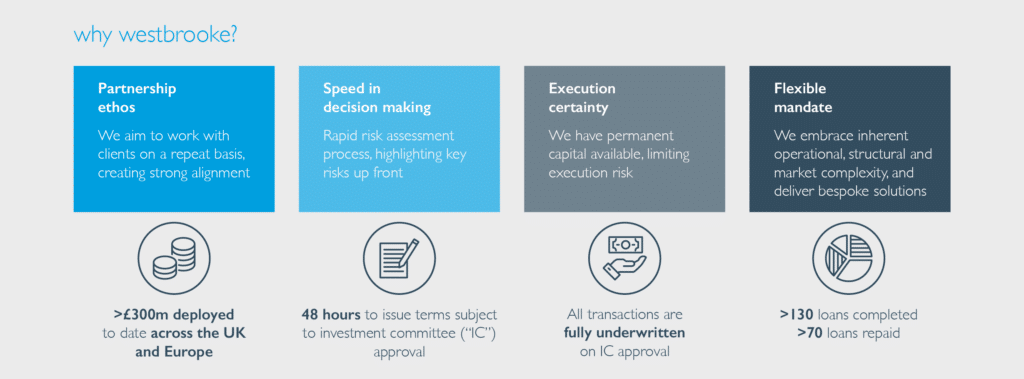

- Westbrooke can compete in the UK private debt market because it is able to structure deals that large commercial banks cannot.

- The Fund has a 5-year track record, having generated predictable, hard-currency cash returns in GBP which have outperformed various comparatives since inception.

Listen to the full episode below:

- The Magic Markets podcast is hosted by The Finance Ghost and Mohammed Nalla. Previous interviews can be accessed here:

- Episode 59 – background to alternatives

- Episode 63 – balancing balance sheets

- Episode 69 – investing in private debt

- Episode 73 – venture capital investing

- Episode 76 – private equity investing

- Episode 81 – hybrid capital

- Episode 87 – USA mobile home park investing

- Episode 94 – the Westbrooke portfolio

- Episode 99 – what’s happening in the UK

- Episode 103 – alternatives – the wealth management view

- Episode 110 – raising capital

- Episode 114 – westbrooke yield plus private debt fund

- Episode 118 – the equity layer in solar investing

- Episode 122 – anchoring alternative investments